We provide strategic financial advice

to startups, project developers, and investors

in the clean technology market.

We advise executives on decisions in four areas.

1._Project Finance Transactions

Immediate support to developer or investor deal teams on purchase and sale of asset portfolios eligible for tax credits including solar, batteries, fuel cells, RNG, and wind

Build or review financial models, CIMs or Investment Memos for capital investments including cash equity, tax equity, debt, and leases.

Manage data room, due diligence, and external advisors such as tax, legal, engineering, appraisal, and other advisors.

Negotiate transaction terms and documents for supply, EPC, O&M, PSA, MIPA, and Operating Agreements.

2._Corporate Finance Transactions

Immediate support to startup, developer or investor deal teams on venture and growth equity investments in clean technology, project development and equipment manufacturing companies

Build or review operating and growth financial models and CIMs.

Manage data room, due diligence, and external advisors.

Advise on valuation and key commercial terms.

3._Commercial Development

Ongoing support to product, project, and business development teams on technical and commercial decisions that are optimized for financeability and profit maximization

Build project financial models, identify key value drivers and risks, and calculate unit economics and other key economic metrics.

Advise on system performance guaranty and warranty terms and key construction milestones based on financeability criteria.

Define key contractual terms in offtake agreements like PPAs, equipment supply agreements, EPC and O&M agreements according to financing requirements.

Analyse new markets and customer use cases to drive technical and commercial strategy.

4._Financial Planning and Analysis

Ongoing support to financial management on defining business key performance indicators (KPIs), building and maintaining a business cash flow projection, and reporting to internal and external stakeholders

Support business planning and strategic planning exercises, as well as lookback analysis on historical plans.

Support business process improvement exercises in a project development or manufacturing business context. Use Lean methods such as SIPOC, As-Is, To-Be, Value Stream Map, and A3 exercises.

About Us

Ahmed Alkelani, CFA

Managing Principal

Ahmed brings over 15 years of specialized experience in advising executives at leading energy and clean technology companies on investing, capital raising, and other strategic finance decisions. Ahmed’s track record includes closed investment and financing opportunities valued between $10 million and $30 billion and spanning a wide range of traditional and clean energy assets. In past roles as a senior advisor to executives at Shell and Bloom Energy, Ahmed led several key processes including:

building thorough financial models for existing and first-of-a-kind situations;

preparing investment memoranda and investor marketing materials;

running bid processes and negotiating various project and transaction contracts;

managing external deal advisors as well as internal deal support teams;

providing financial advice on product, project and market development efforts;

and leading business planning, strategic planning, and performance appraisal processes.

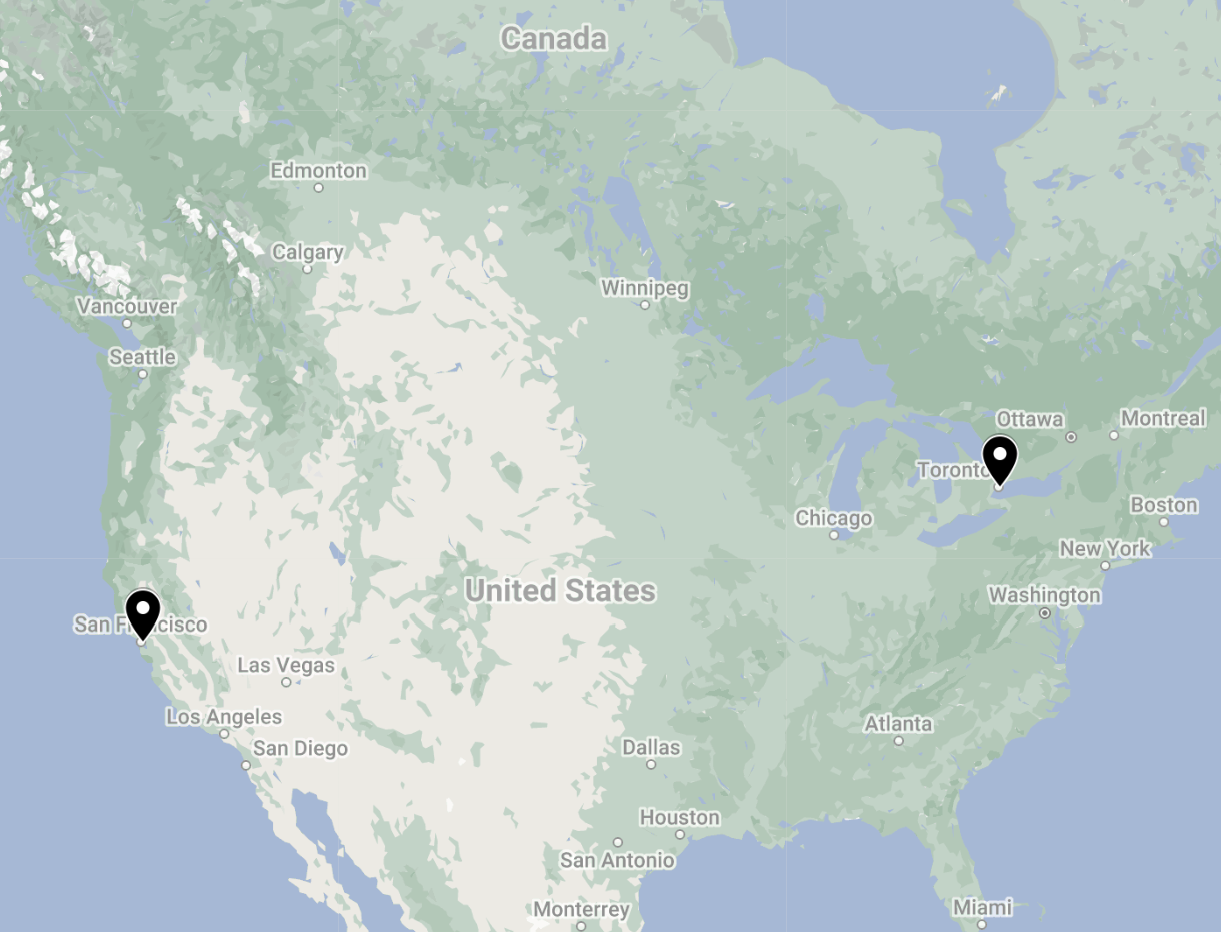

Ahmed was most recently a Director of Structured Finance and Corporate Development at Bloom Energy for 6 years, focused on capital raising from cash equity, tax equity and debt investors for portfolios of fuel cell distributed generation and small utility projects in the United States. He was previously a Senior Economic Advisor at Shell for 5 years, focused on capital project and M&A investments in the shale natural gas industry in Canada. Ahmed began his career in gas and power sales and trading at Shell. He is a CFA Charterholder and a graduate of the University of Toronto with an Honors Bachelor of Arts in Economics.

Ahmed lives in Alameda, California with his wife and baby daughter.

Our Purpose

There is a global race to replace over century-old infrastructure systems, including energy, water and waste management, within a few short decades. Policy-makers, large companies, startups and investors are racing to influence and react to infrastructure markets that are constantly changing. While incumbents review their asset portfolios, innovative startups, developers and investors are shaping and targeting new infrastructure markets.

Topspin Capital was created to help technology and project developers grow by securing scalable, low-cost financing and targeting new markets.

Topspin Capital also intends to help investors deploy capital by evaluating, transacting, and managing investments in clean technology companies and projects.

We provide clients strategic financial advice based on investing and financing experience acquired at operating companies who are industry leaders in energy and clean technology.

Our services are best suited for clients who value flexibility and require immediate support to close project or corporate financing transactions, or who require ongoing support to develop financeable products, projects, and businesses.

Contact Us

Interested in working together? Send us a message and we will be in touch soon.